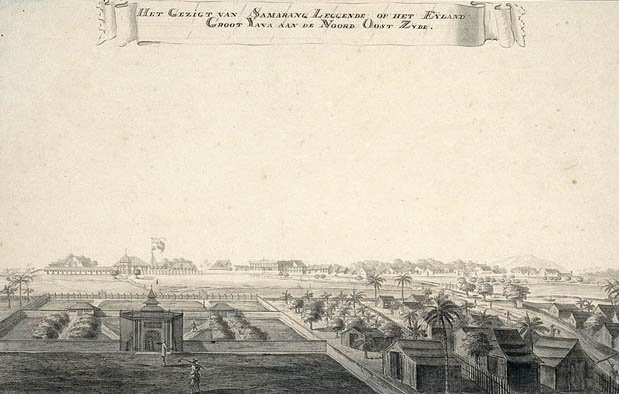

Kota Semarang yaitu kota metropolitan terbesar kelima di Indonesia, sehabis Jakarta, Surabaya, Bandung, dan Medan. Sekitar 2,5 juta jiwa hidup di kota yang luasnya 373 km2 ini. Kota Semarang mempunyai riwayat sejarah panjang. Kisahnya bahkan diperkirakan dimulai semenjak masa ke-6 Masehi. Bagi Anda yang ingin tahu bagaimana asal undangan kota Semarang dan perkembangannya sampai ketika ini, simaklah uraiannya yang kami intisarikan dari beberapa sumber, berikut ini.

Seiring perkembangan zaman, pada masa kekuasaan kerajaan Demak, seorang pangeran berjulukan Raden Made Pandan diutus untuk membuatkan fatwa Islam di wilayah Bergota ini. Ia dan putranya, Raden Pandanarang yaitu dua ulama aristokrat yang sangat diterima oleh masyarakat Bergota yang kala itu masih memeluk agama Hindu Budha. Kedatangan kedua ulama tersebut juga membawa perubahan besar bagi kemajuan Bergota.

Bergota yang menjadi asal usul Kota Semarang ini sebelum kedatangan Raden Made Pandan yaitu tempat yang sepi dan masih terdapat banyak hutan. Daerah ini dulunya tidak sanggup ditanami oleh tanaman pangan alasannya airnya berasa payau. Namun sehabis kedatangan Raden Made Pandan dan putranya, melalui ilmu irigasi yang dimiliki, tempat ini kemudian disulap menjadi areal pertanian yang subur.

Pesatnya perkembangan dakwah Islam dan suburnya tanah Bergota, perlahan tapi niscaya telah mengundang banyak orang untuk tiba dan menetap di sana. Daerah yang menjadi asal undangan Kota Semarang ini kemudian ramai dan dihuni oleh banyak pendatang dari seluruh pelosok kerajaan Demak.

Seiring waktu berlalu, Raden Made Pandan kemudian berangsur sepuh dan balasannya wafat. Semenjak meninggalnya Sang Raden, tempat pertanian Bergota kemudian mulai ditumbuhi banyak pohon asam Jawa. Melihat fenomena ini, putranya dan masyarakat sekitar kemudian mengubah nama Bergota menjadi Semarang. Kata Semarang sendiri berasal dari 2 kata yaitu Asem dan Arang yang berarti pohon asem yang tumbuh jarang-jarang.

Nama Semarang pun kemudian mulai dikenal dan menyebar sampai kini. Sejak perubahan nama itu pula, Semarang menjadi kian ramai. Bertepatan dengan Maulid Nabi 12 Rabiul Awal 954 H atau 2 Mei 1547, nama Semarang kemudian disahkan Sultan Hadiwijaya (Sultan Pajang) sehabis ia berkonsultasi dengan Sunan Kalijaga. Tanggal 2 Mei ini kemudian kini ditetapkan sebagai hari jadi Kota Semarang dan diperingati setiap tahun sampai sekarang.

Nah, demikianlah sejarah di balik asal undangan kota Semarang. Kota yang kini menjadi sangat ramai berkat jasa Raden Made Pandan dan putranya Raden Pandanarang. Sudah cukup terang bukan? Jika ada pertanyaan atau saran dari Anda, para pembaca dari Kota Semarang untuk kebaikan artikel ini, silakan cantumkan komentar pada kolom di bawah.

Asal Usul Kota Semarang

Asal undangan Kota Semarang diawali pada sekitar masa ke-6 Masehi. Pada masa tersebut, kota yang kini dihuni oleh 2,5 juta jiwa itu dulunya yaitu tempat pesisir berjulukan Bergota, sebuah tempat pesisir maritim bab dari kerajaan Mataram Kuno. Di pesisir Bergota ini, terdapat beberapa deretan pulau kecil yang alasannya pengendapan, deretan pulau-pulau tersebut kemudian menyatu membentuk daratan yang cukup luas.Seiring perkembangan zaman, pada masa kekuasaan kerajaan Demak, seorang pangeran berjulukan Raden Made Pandan diutus untuk membuatkan fatwa Islam di wilayah Bergota ini. Ia dan putranya, Raden Pandanarang yaitu dua ulama aristokrat yang sangat diterima oleh masyarakat Bergota yang kala itu masih memeluk agama Hindu Budha. Kedatangan kedua ulama tersebut juga membawa perubahan besar bagi kemajuan Bergota.

Bergota yang menjadi asal usul Kota Semarang ini sebelum kedatangan Raden Made Pandan yaitu tempat yang sepi dan masih terdapat banyak hutan. Daerah ini dulunya tidak sanggup ditanami oleh tanaman pangan alasannya airnya berasa payau. Namun sehabis kedatangan Raden Made Pandan dan putranya, melalui ilmu irigasi yang dimiliki, tempat ini kemudian disulap menjadi areal pertanian yang subur.

Pesatnya perkembangan dakwah Islam dan suburnya tanah Bergota, perlahan tapi niscaya telah mengundang banyak orang untuk tiba dan menetap di sana. Daerah yang menjadi asal undangan Kota Semarang ini kemudian ramai dan dihuni oleh banyak pendatang dari seluruh pelosok kerajaan Demak.

Seiring waktu berlalu, Raden Made Pandan kemudian berangsur sepuh dan balasannya wafat. Semenjak meninggalnya Sang Raden, tempat pertanian Bergota kemudian mulai ditumbuhi banyak pohon asam Jawa. Melihat fenomena ini, putranya dan masyarakat sekitar kemudian mengubah nama Bergota menjadi Semarang. Kata Semarang sendiri berasal dari 2 kata yaitu Asem dan Arang yang berarti pohon asem yang tumbuh jarang-jarang.

Nama Semarang pun kemudian mulai dikenal dan menyebar sampai kini. Sejak perubahan nama itu pula, Semarang menjadi kian ramai. Bertepatan dengan Maulid Nabi 12 Rabiul Awal 954 H atau 2 Mei 1547, nama Semarang kemudian disahkan Sultan Hadiwijaya (Sultan Pajang) sehabis ia berkonsultasi dengan Sunan Kalijaga. Tanggal 2 Mei ini kemudian kini ditetapkan sebagai hari jadi Kota Semarang dan diperingati setiap tahun sampai sekarang.

Nah, demikianlah sejarah di balik asal undangan kota Semarang. Kota yang kini menjadi sangat ramai berkat jasa Raden Made Pandan dan putranya Raden Pandanarang. Sudah cukup terang bukan? Jika ada pertanyaan atau saran dari Anda, para pembaca dari Kota Semarang untuk kebaikan artikel ini, silakan cantumkan komentar pada kolom di bawah.